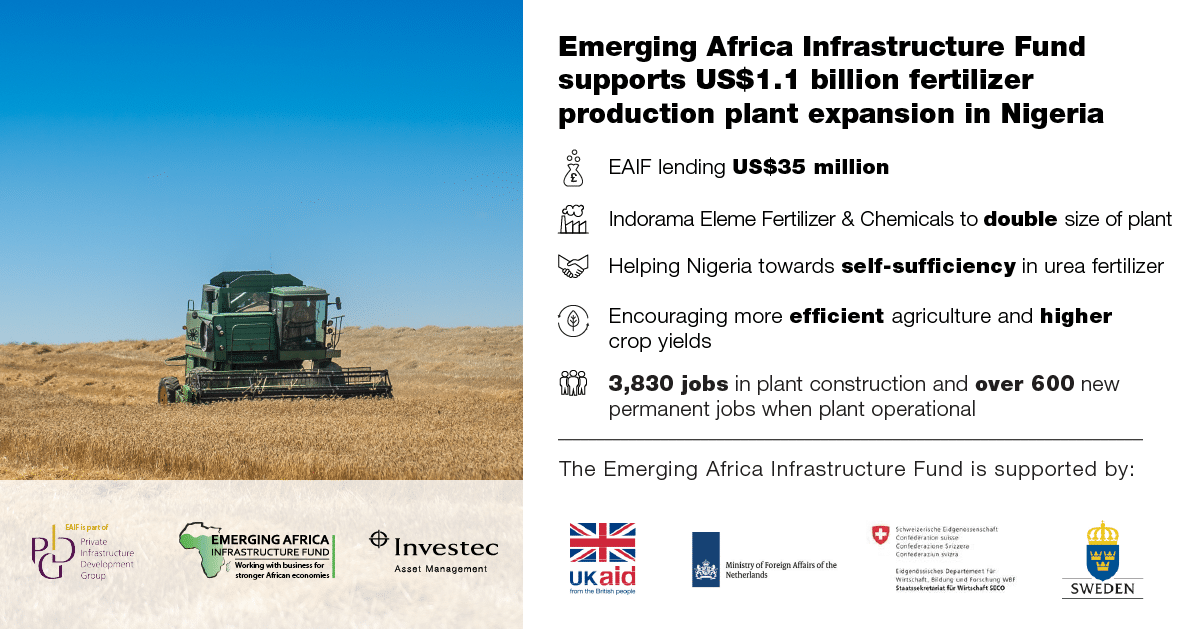

EAIF lends US$35 million to US$1.1 billion project to double production at Nigeria’s largest fertiliser plant

The Emerging Africa Infrastructure Fund (EAIF), today announced the financial close of its 11-year US$35 million loan to Indorama Eleme Fertilizer & Chemicals Ltd (IEFCL). The transaction is part of the financing of a US$1.1 billion expansion of the company’s existing fertiliser plant at Port Harcourt, Nigeria. The new plant is to be built alongside the existing facility. It will double the company’s output annually to 2.8 million metric tonnes.

- Financial close achieved on 21st August

- Big step towards Nigeria being self-sufficient in urea fertiliser

- Contributing to more efficient agriculture and higher crop yields

- Jobs for 3,830 people during plant construction and 608 permanent posts

EAIF is a member of the Private Infrastructure Development Group (PIDG). PIDG encourages and mobilises private investment in infrastructure in the frontier markets of sub-Saharan Africa, south and south-east Asia, to help promote economic development and combat poverty.

“Leading role”

Commenting on the expansion of IEFCL’s Port Harcourt plant, Indorama Africa’s Chief Executive Officer, Manish Mundra, says:

“Nigeria has enormous potential to achieve agricultural self-sufficiency and food security. This is evident from the multi-fold increase in domestic fertiliser consumption after the start of Indorama’s first plant. Nigeria has also become a major hub for urea exports. With Line 2, we aim to further expand our ability to provide competitively priced and high-quality fertiliser to farmers in West Africa and across the globe. Indorama is looking forward to continuing to contribute to Nigeria’s economic development.

“I am delighted that PIDG company EAIF is again assisting us to grow our business and that IEFCL and EAIF are helping power Nigeria’s economic development.”

EAIF previously provided loans of US$48.8 million towards construction of IEFCL’s first Port Harcourt fertiliser plant, which is now operating at full capacity. The new plant will share the existing infrastructure that supplies energy, water and port facilities. The infrastructure at the adjacent port of Onne is to be expanded to meet the needs of the enlarged fertiliser plant. An additional 11km of new gas pipeline that serves the IEFCL facility has already been added to the 84km installed when the present plant was constructed.

“Help combat poverty”

EAIF Chair, Patrick Crawford, says;

“A successful and productive agriculture sector is essential to Nigeria’s future. The new plant for Indorama Eleme can benefit farming communities across Nigeria, which will help combat poverty, stimulate employment and improve the resilience of the Nigerian economy. Projects like IEFCL’s Port Harcourt expansion are of fundamental strategic importance and of exactly the type PIDG and its companies are there to support.”

Reducing imports and boosting jobs

The project directly supports the Nigerian government’s initiative to eliminate the importation of urea and to meet rising local demand for urea fertiliser. 3,830 people are to be hired to build the new plant. 608 people will have permanent jobs when it comes on stream. Construction is expected to take up to 37 months.

“Prime example of blended finance”

Nazmeera Moola, who heads the EAIF team at Investec Asset Management, says; “The Port Harcourt project is a prime example of EAIF’s finance making big infrastructure projects possible and developing private banks’ confidence to invest in emerging markets.

“International private sector banks have been attracted to support the project because of the track record of IEFCL and the structure of the finance, which sees debt providers like EAIF supply 11-year loans, while private banks have preferred 8-year loans. It’s a prime example of blending public and private capital to the strategic benefit of the Nigerian economy and delivering tangible benefits to millions of people”.

Indorama Corporation in 29 countries

Indorama Eleme Fertilizer & Chemicals Ltd is 75.9% owned by Indorama Corporation Pte Ltd, one of Asia’s leading chemicals holdings companies. Along with its subsidiaries and key associates, it currently has 77 manufacturing complexes in 29 countries in Asia, Africa, Europe, CIS and North America. It employs over 31,000 people from c35 nationalities and has revenues of cUS$11 billion.

The lending group

The International Finance Corporation was Joint Mandated Lead Arranger with EIB, Yes Bank, CDC, African Development Bank, Bank of Baroda and Standard Bank. In addition to the Emerging Africa Infrastructure Fund, the other banks and development finance institutions supporting the financing are Standard Chartered Bank, Bangkok Bank, FMO, DEG, PROPARCO, ICICI and Citibank. IFC will directly lend US$100 million and mobilise an additional US$850 million of loans from the other developmental financial institutions and commercial banks. Another US$50 million in financing will be available from IFC’s Managed Co-Lending Portfolio Program.